SYMPHONY G2

The clearest way to

manage the entire life cycle

of capital market assets

manage the entire life cycle

of capital market assets

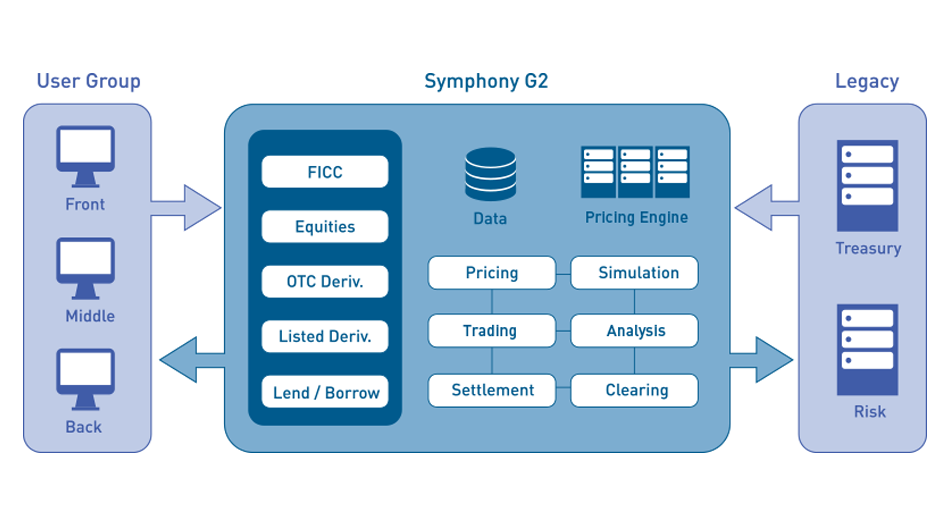

| Front-to-Back Platform for Capital Market Assets |

|

| The Symphony G2 is a comprehensive software system that

supports the entire life cycle of capital market assets from

the pre-trade analysis, through to the trade and maturity on a

single platform. The Symphony G2 minimizes the number of systems, simplifies architecture, streamlines processes and improves efficiency, reducing the total costs of ownership for the client. |

| FDK-e | Plug-in | Data | Legacy | External |

|

||||

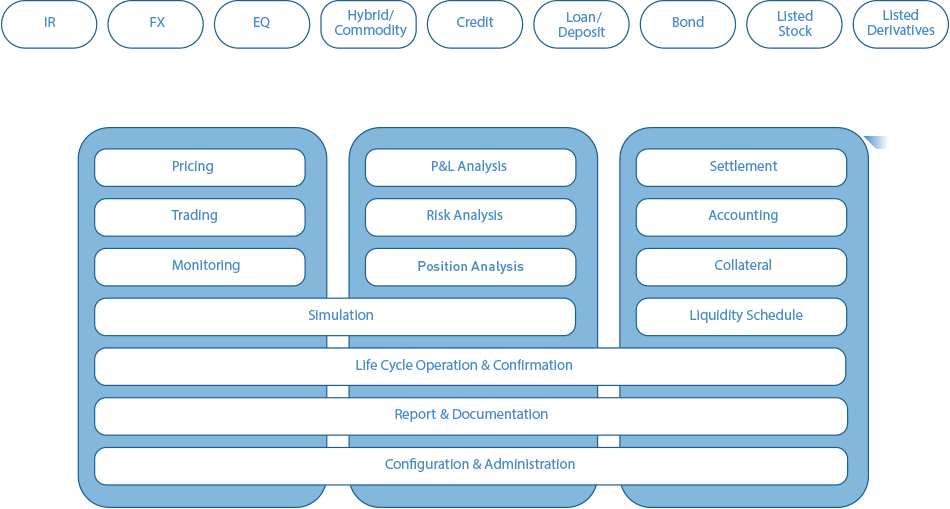

| Product Coverage | |

| The Symphony G2 supports all products traded on capital markets including Equities, Bonds, Foreign Exchange, Credits, and their Derivative, Structured, and Hybrid products. The following categories and products are supported: |

| Foreign Exchange FX Spots, Forwards, Swaps, NDF (Non-Deliverable Forwards), NDS (Non-Deliverable FX Swaps), Vanilla and Exotic Options, Structured FX Forwards. |

Credits Vanilla CLN (Credit Linked Notes), Highly Structured CLN, Option Embedded CDS (Credit Default Swaps), CLS (Credit Linked Swaps) |

||

| Fixed Income Sovereign Bonds, Treasury Bonds and Notes, Corporate Bonds, Coupon Bonds, Zero-coupon Bonds, Term Loan Bonds, Discount Bonds, Equity Convertible Bonds, Exchangeable Bonds, Bonds with Warrants |

Equities Stocks, Vanilla Futures and Options, Exotic Options, Structured Equity Performance Options and Swaps, ELS (Equity Linked Securities), ELB (Equity Linked Bonds), ELD (Equity Linked Deposits), ELF (Equity Linked Funds), ELW (Equity Linked Warrants) |

||

| Interest Rate Loans/Deposits, CD (Certificates of Deposit), CP (Corporate Papers), Repo (Repurchase Bonds), FRN (Floating-Rate Notes), Interest Rate Swaps, Cross Currency Swaps, IR Structured Notes and Swaps, Swaptions, Caps/Floors |

Hybrids & Commodities Commodity-based Vanilla, Exotic and Structured Futures and Options, Structured Cross Asset (Equity, Interest Rate, Foreign Exchange, Commodity) Options and Swaps, Securitized Cross Asset Notes |

Functions |

|||

1 |

Front Office The Symphony G2 front office supports the pre-trade analysis, product design, price simulation and virtual trading. It provides FV (Fair Value), Greeks and VaR (Value At Risk) as well as CVA (Credit Valuation Adjustment), DVA (Debt Valuation Adjustment), and FVA (Funding Valuation Adjustment). It also runs Ad hoc simulations in accordance with changes of the underlying asset price, interest rate curves, volatility curves, and time flows. Furthermore, it processes trade entry, trade capture, and post-trade operations such as re-fixing, corporate actions, redemptions, maturities, etc. |

3 |

Back Office The Symphony G2 back office provides trade and event confirmations, settlement instructions, cash inventories, cash in/out flow schedules and accounting journals (balance sheets and P/L statement data). It also processes third party interface messages, collateral revaluation and margin calculations, and generates various other formal and informal reports. |

2 |

Middle Office The Symphony G2 middle office supports P/L and risk analysis for all booked positions by user-defined book management hierarchy. Realized and unrealized P/L is generated based on real-time revaluation or daily mark-to-market. Valuation, cash flow estimation and other position analyses are automatically updated based on the change of trades and market data. Furthermore, risk factors (including delta, gamma, vega, theta etc.) as well as VaR (parametric, historical and Monte Carlo simulation) are generated with ease. |

||

Technology |

|||

1 |

Single-Platform Straight

Through Process (STP) The Symphony G2’s cross-asset, front-to-back architecture has been developed since its inception as a single platform, making it an ideal system for consolidation, simplification and extension. It achieves real-time STP by processing trades, valuations, P/L analysis, risk analysis and accounting on a single input. As a result, the client is able to minimize the number of programs used, streamline processes, enhance the efficiency of daily operations, and minimize the total cost of ownership (TCO). |

4 |

Pricing Engine Plug-in

Architecture The engine plug-in function allows the Symphony G2 to run not only the FDK (embedded pricing engine) but also pricing engines of clients and third parties. The plug-in API (Application Program Interface) is provided for various OS including Linux, Unix, and Windows. |

2 |

Module-Based Architecture The Symphony G2 is custom-built to meet the specific needs and workflows of the client, as it is composed of separable modules such as the pricing engine, structuring ingredients and work process units. Furthermore, it provides a flexible environment for handling changes in work processes and introduction of new products. Thus, it incorporates the addition of structuring modules and processes workflow configuration resets with ease. |

5 |

Grid Computing

Architecture The Symphony G2 allows for the pricing engine, including the FDK and plug-in engines, to run on multiple servers and CPU cores through grid computing architecture. Thus, when trades and position volumes are dramatically increased, the client simply incorporates additional servers or CPU cores, preventing any delay in real-time processing and revaluation. |

3 |

Multi-Threaded Architecture The Symphony G2 supports multi-threaded processing which controls the number of processors in accordance with the increase or decrease in simultaneous users, in the desks of front, middle and back office as well as regional branches or lab offices. Its multi-threaded processing successfully prevents latency risks of servers in case of multiple users' accessing and operating the system at any time, from various locations. |

||

Product

Composition |

|||

1 |

Pricing Engine (FDK) The Symphony FDK is a highly flexible and transparent framework for computing price, greeks and performing scenario analyses on any data set. The FDK processes a comprehensive range of approximately 12,000 product types, from simple and conventional products to newly introduced, varied and complex structured products. The FDK provides APIs for C, C++, C# and Java on Linux or Unix Servers as well as DLLs of Windows. |

4 |

Back Office (SBO) The Symphony SBO supports all back office operations on a single platform. Back office functions including settlement, clearing, collateral, accounting, regulatory reports, and liquidity reports, are automatically adjusted with market data changes and front office trade and events, resulting in a seamless and effective straight through process (STP). |

2 |

Product Control (SPC) The Symphony SPC allows users to design specific product structures and to register and manage them in coherence with their product classification or hierarchy standards. The client is also able to set a commonly traded product type as a template for convenient, frequent use. The SPC includes all functions of the SSQ (The Smart Quant) such as product design, pre-trade and post-trade pricing, risk factor calculation, cash flow generation, ad hoc and scenario simulation, and term sheet generation. The distinction is that the SPC is served as an in-house solution, unlike the SSQ's ASP (Application Service Providing) solution. Users are able to incorporate into the SPC the market data owned by Symphony G2 as well as external market data from third party vendors such as Bloomberg, Reuters, C-screen and etc. |

5 |

The Smart Quant (SSQ) As a financial quant supporting system, The Smart Quant (SSQ) provides calculations of fair value, risk, internal rate of return and par swap rate. The SSQ runs pricing simulations against various financial instruments on the market as well as those that are already on client books. It is served as an ASP (Application Service Providing) with reliable, real-time market data. Clients simply fill in product conditions and select market data groups in order to run calculations and simulations. The SSQ is the ASP version of SPC (Product Control). |

3 |

Trade & Position (STP) There are two methods to enter trades into the Symphony STP; from the products registered on the SPC, or from external systems via an interface. The STP allows users to input their trades of both external and internal counter parties as well as divide trades into notes and options. All trades are automatically listed in the preferred format of the client. And position revaluation, P/L calculation, position risk analysis, etc. are processed in real-time. The STP monitors positions according to product conditions and market data, automatically notifying the user and processing re-fixing, redemption, knock-in/out, and touch as soon as such conditions are met. |

||