MIT CORPORATION

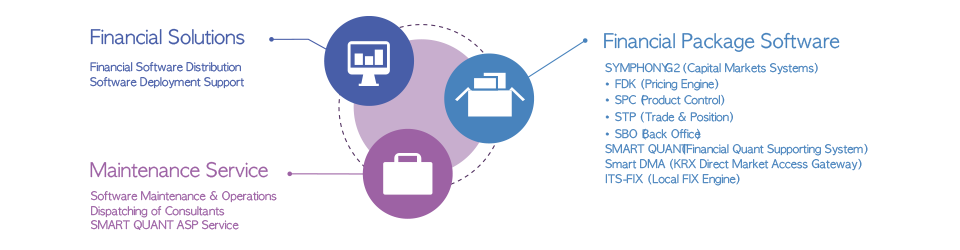

MIT (Mugunghwa Information Technology) Corporation's products and

services are focused on the needs of the financial services industry

and cover the complete life cycle of a software solution ranging

from supporting the application design stages to the delivery and

integration of the application with the clients' infrastructure.

MIT is a leading player in the financial services industry,

providing efficiency in every step of the life cycle of software

solutions; from the application design stage to the delivery, and

integration with client infrastructure.

We Provide Professional Financial Solutions and Services.

Since its establishment in September 1998, MIT has invested heavily in developing and enhancing financial software for complex derivatives and structured financial instruments, and has provided mission critical support for client operations.

We Provide Professional Financial Solutions and Services.

Since its establishment in September 1998, MIT has invested heavily in developing and enhancing financial software for complex derivatives and structured financial instruments, and has provided mission critical support for client operations.

Our signature product, the Symphony G2 is a front-to-back office solution for cross-asset financial

products including: Equities, Bonds, Foreign Exchange, Money Market Instruments, Interest Rates,

Commodities, Credits, and their Derivative, Structured and Hybrid products. With more than 17 years

of experience delivering solutions for cross-asset pricing, trading, processing, risk management and

accounting, we are able to quickly understand the diverse needs of our customers and provide simplicity

to the most complex tasks.

Our goal is to continue to excel in developing technology solutions that are reliable, streamlined, and scalable. As a result, our clients are able to quickly adapt to changes in regulations and achieve improved allocation of capital and risk management.

Our goal is to continue to excel in developing technology solutions that are reliable, streamlined, and scalable. As a result, our clients are able to quickly adapt to changes in regulations and achieve improved allocation of capital and risk management.

Supported Cross-Asset Products |

- Equities

- Foreign Exchange - Money Market Instruments - Bonds and Fixed Income - Interest Rates - Commodities - Derivatives - Hybrid and Structured Products |

Diverse Client Base |

- Commercial Banks

- Investment Banks - Private Banks - Prime Brokers - Insurance Companies - Asset Managers - Treasuries - Hedge Funds Managers - Custodians - Clearing Brokers and FCMs |